Image source: https://image.slidesharecdn.com/ljqe3byfqbe8hm239y9b-signature-dd893d323988ddf333859cac1cd96fc68dd1a03a23ecf13182472d34e8c290cf-poli-150828104349-lva1-app6891/95/solvency-profitability-ratios-3-638.jpg?cb=1440758972

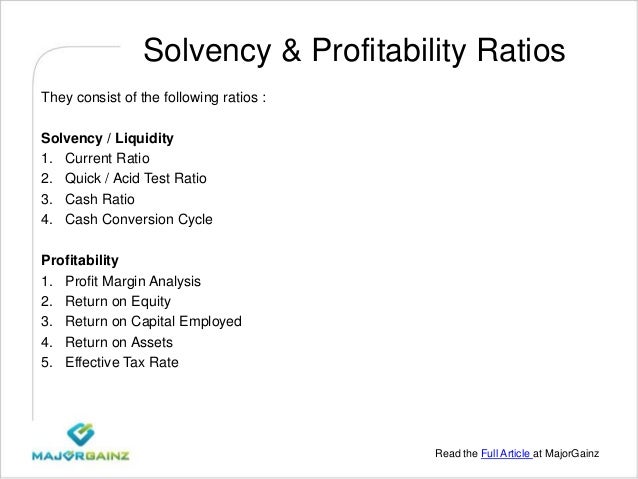

Profitability

Is the company making money? Is it making more or less than it did in the prior period? Are sales growing? Are profits growing? You can answer these questions by looking at the following ratios:

Return on Equity

Common Size Ratio (Income Statement)

Return on Assets

Solvency

Is the company keeping debts and other liabilities under control? Are the companys assets growing? Is the companys net equity (or net worth or stockholders equity) growing? You can answer these questions by looking at the following ratios:

Debt-to-Net-Equity

Working Capital

Quick Ratio

While you examine ratios, keep these points in mind

- Not every company and/or industry is the same. A ratio that seems problematic in one industry may be just fine in another. Investigate.

-A single ratio isnt enough on which to base your investment decision. Look at several ratios covering the major aspects of a companys finances.

- Look at two or more years of a companys numbers to judge whether the most recent ratio is better, worse, or unchanged from the previous years ratio. Ratios can give you early warning signs regarding the companys prospects.

Liquidity Ratios

Liquidity means the ability to quickly turn assets into cash. Liquid assets are simply assets that are easier to convert to cash. Real estate, for example, is certainly an asset, but its not liquid because converting it to cash could take weeks, months, or even years. Current assets such as checking accounts, savings accounts, marketable securities, accounts receivable, and inventory are much easier to sell or convert to cash in a very short period of time. Paying bills or immediate debt takes liquidity. Liquidity ratios help you understand a companys ability to pay its current liabilities. The most common liquidity ratios are the current ratio and the quick ratio, the numbers to calculate them are located on the balance sheet.

Operating Ratios

Operating ratios essentially measure the company efficiency. How is the company managing its resources? is a question commonly answered with operating ratios. If, for example, a company sells products, does it have too much inventory? If it does, that could impair the companys operations.

Solvency Ratios

Solvency just means that the company isnt overwhelmed by its liabilities. Insolvency means Oops! Too late. You get the point. Solvency ratios have never been more important than they are now. Solvency ratios look at the relationship between what the company owns and what it owes.

Common Size Ratios

Common size ratios offer simple comparisons. You have common size ratios for both the balance sheet (where you compare total assets) and the income statement (where you compare total sales)-

- To get a common size ratio from a balance sheet, the total assets figure is assigned the percentage of 100 percent. Every other item on the balance sheet is represented as a percentage of total assets. For example, if Holee Guacamolee Corp. (HGC) has total assets of $10,000 and debt of $3,000, you know that total assets equal 100 percent, while debt equals 30 percent (debt divided by total assets or $3,000 $10,000, which equals 30 percent).

- To get a common size ratio from an income statement (or profit and loss statement), you compare total sales. For example, if a company has $50,000 in total sales and a net profit of $8,000, then you know that the profit equals 16 percent of total sales.